If you are wondering how to invest in mutual funds in Pakistan, then you’re at the right place. In the next few minutes, you will know exactly how to open a mutual fund account with an asset management company like Al Meezan and make your first deposit.

So, without further ado, let’s get started.

What is a Mutual Fund and where do they invest your money?

First things first, a mutual fund is a pool of a company known as an “Asset Management Company” that takes money from different investors and invests it somewhere. But where?

There are many funds inside a mutual fund. There is an equity fund where your money is invested into the stock market or there is a debt fund or money market fund where your money goes into government securities.

First, you create a mutual fund account then select a fund of your choice to invest your money in it. You can also invest in multiple funds at the same time from a mutual funds account.

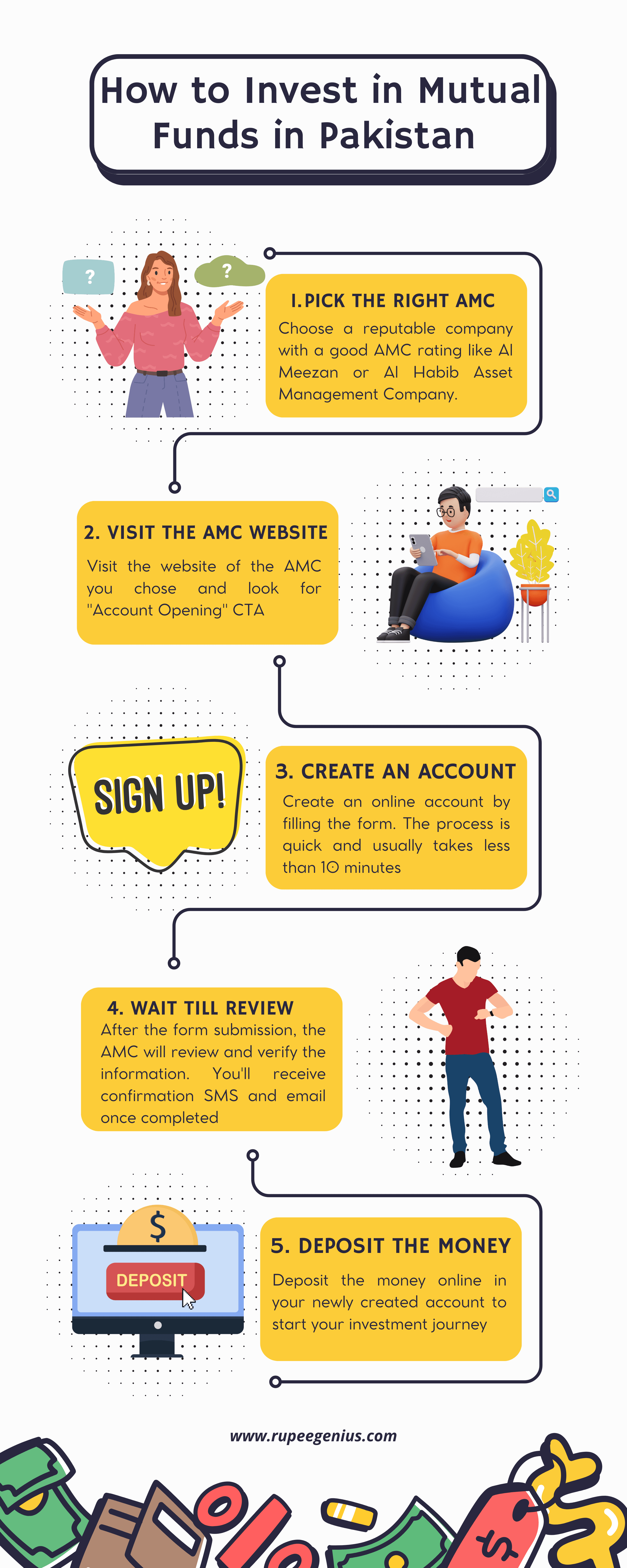

5-step process to invest in mutual funds in Pakistan

Investing in mutual funds used to be a tedious process in Pakistan. But since COVID, the process has been tremendously simplified.

Now you can open your mutual funds account online from the comfort of your home.

Follow this 5-step process to invest in mutual funds in Pakistan like Al Meezan.

1. Pick the right asset management company

The first step is choosing the right company for your investment journey. You don’t have to be very detail-oriented here but pick a well-reputed company with a good AMC rating.

Almost, all the banks in Pakistan have their AMC segments like Meezan Bank, Habib Bank, Bank al Habib, and others so you can go with any of them.

For demonstration in this tutorial, we’ll be sticking with Al Meezan which is a mutual fund wing of Meezan Bank. It’s the biggest Asset Management Company in Pakistan with an excellent track record.

You may go with it or any other of your choice.

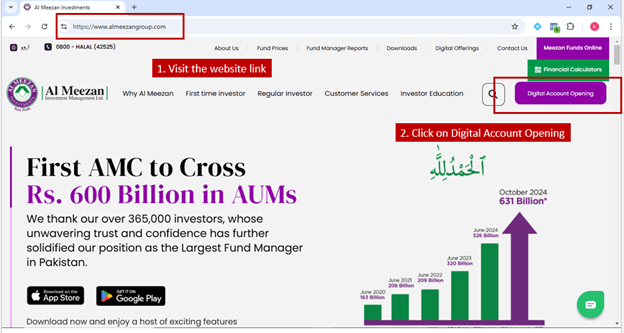

2. Visit the AMC website

Before investing in mutual funds in Pakistan, you need to create an account with an AMC. Therefore, the next step is to visit the AMC website you selected and initiate the account creation process. There will be an option like digital account opening or online account opening in the header.

For Al Meezan, follow the below-mentioned process.

3. Create an Account

Creating an account with AMC is quite an easy process now and doesn’t take more than 10 minutes or even less.

The account opening process for all AMCs is more or less the same.

For Al Meezan, follow these steps to create the mutual fund account.

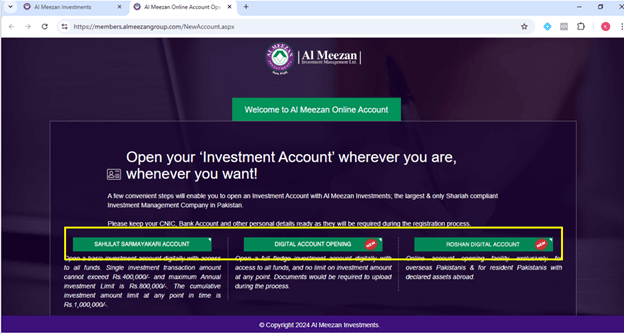

Digital Account Opening Page.

After clicking on “Digital Account Opening”, you will land on this page.

You can see three options:

- Sahulat Sarmayakari Account: For Pakistani nationals with no income proof. If you are a student, housewife, or anyone with CNIC but no income proof, then select this. It has an investment cap of 1 million PKR, meaning that you will not be able to invest more than 1,000,000 PKR with this option.

- Digital Account: It is a full-fledged mutual fund account where there is no investment cap. You can invest an unlimited amount with this option but it needs income proof. If you have your salary slip, then you can go with this option.

- Roshan Digital Account: This is for overseas Pakistanis who want to open a mutual fund account in Pakistan. It also doesn’t have any investment cap.

Select your desired option. Here we will select Digital Account for the tutorial.

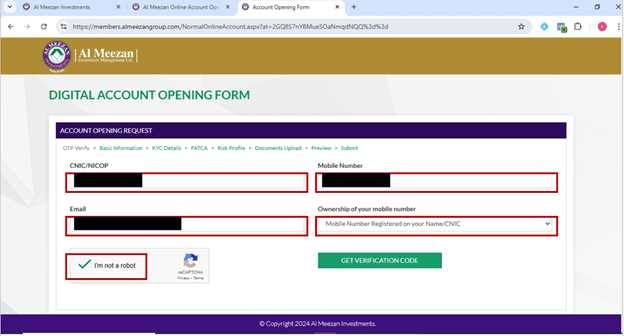

Digital Account Opening Form.

You will land on this screen.

- Enter your CNIC, Mobile Number, and Email. Select “Mobile number registered in your name/CNIC” if you have a sim on your CNIC. If you have a sim in a family member’s name, select the respective option.

- Don’t forget to click on “I am not a robot”.

- Click on “Get verification code”.

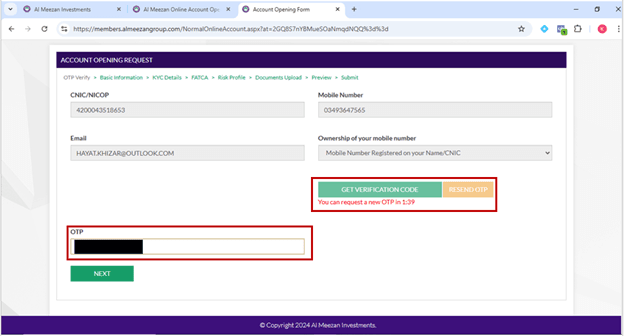

OTP Verification.

You will get on this screen.

You will get 4 digits code on your sim. Put them in the OTP field and click on next.

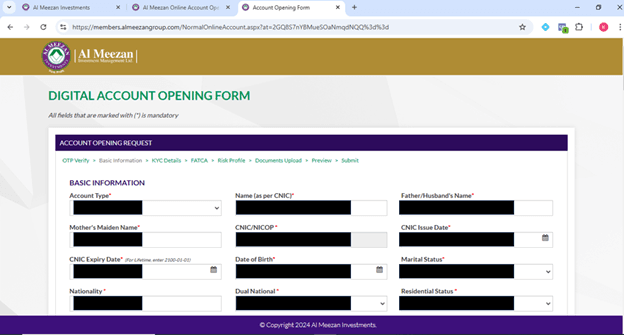

Digital Account Opening – Basic Information Tab.

You will land on this screen.

It is a long form but we have only shown the top part of it. Fill the complete form from top to bottom then click “Save and next” on the bottom page.

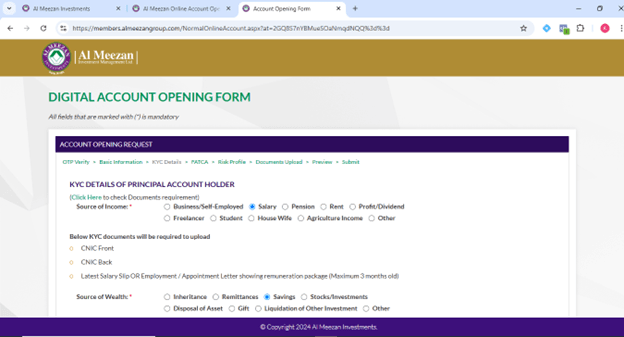

Digital Account Opening – KYC Details Tab.

You will get on this screen.

Fill in the complete details. On the bottom of the page, click “Save and Next”.

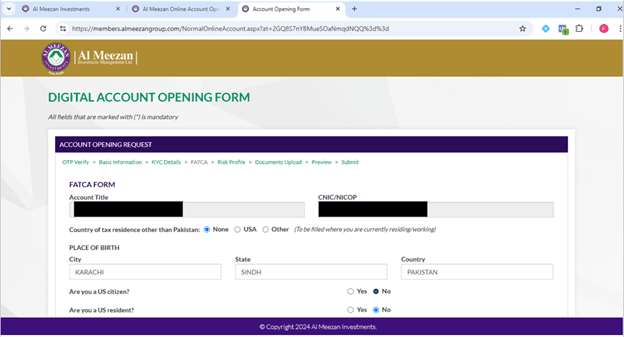

Digital Account Opening – FATCA Form.

You will get to this screen.

Fill in the details again and click on “save and next”.

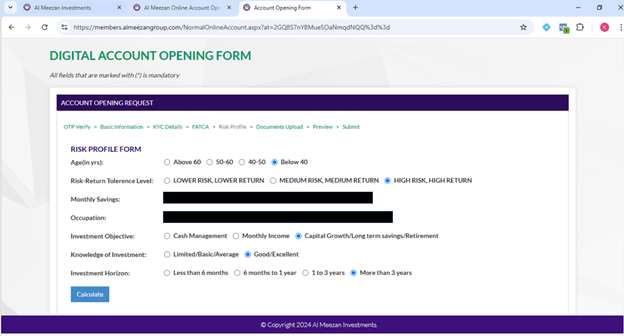

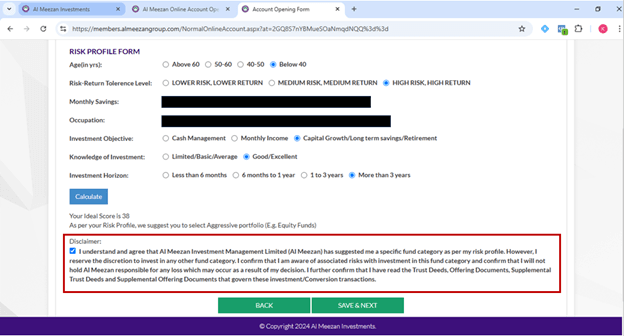

Risk Profile Tab.

You will get on the screen of the risk profile.

Fill out your risk profile. It is only for recommendation; it won’t matter in your account opening. It only suggests where you should invest based on your age and investment objective.

After entering your values, click on “calculate”. It will suggest to you where you should invest with the mutual fund account.

Check the disclaimer at the bottom of the page and click on “save and next”.

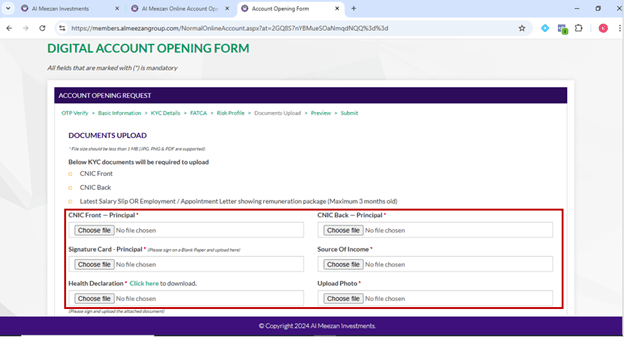

Documents Upload Tab.

You will get on this screen.

Now, scan and upload your CNIC front, CNIC back, your signature on blank paper, income proof/salary slip, and your photo.

We can see the Health declaration in the above photo because we are opening a Mutual Funds + Pension Account. In case you only want to invest in a mutual fund, you won’t see this option.

After uploading the documents, click on “save and next” at the bottom. Review the form you have filled then submit it.

4. Wait for a few days for Review

After you’ve successfully submitted the forms with all the details, you’ll enter the review stage. The AMC will verify the details you’ve submitted. In case of any discrepancy, you’ll be communicated about the issue through email or call and be guided about the necessary steps.

In our case, we had a different address on the CNIC from the present living address. Al Meezan asked us to send them a paid bill of electricity over email and the issue was resolved right away.

Ideally, the review stage will take 2 to 3 working days and you’ll be informed about the successful completion over your email.

5. Deposit the money in mutual funds account

Just like you need to deposit money when opening a bank account, in the same manner, you need to deposit the money in your newly created mutual funds account to activate it.

The amount that you need to deposit will be the same as the one you selected when filling out the account opening form earlier.

The payment medium and method will be communicated in the same email. You can usually deposit through RAAST ID or KUICKPAY. Whatever the case, it will be mentioned in the email with actionable steps.

In our case, we had deposited the required amount through KUICKPAY as it was the only method we had received in the email.

Depositing and withdrawing money after opening the account

If you follow the above steps including the initial payment deposit, your mutual funds account will be opened and activated.

Now you’re free to deposit more cash or withdraw your money out of it just like a regular bank account.

The only exception is that the transaction will take around 2 working days to process.

Investing more money or withdrawing in a mutual funds account

To invest more money in a mutual funds account, first make sure that your bank account connected with the mutual fund has sufficient balance.

Then select the desired fund as per your objectives from the account dashboard and select the amount you want to deposit.

It will take 2 working days to process and you’ll get the fund units in your account.

To withdraw your money from the mutual funds account, look for the redemption option then select the amount you want to withdraw.

Your fund units will be sold and you’ll get the cash in your connected bank account after 2 working days.

Conclusion

You now know how to invest in mutual funds in Pakistan. The investment process has been made quite easy since covid as now you can open and activate your mutual fund account without visiting any branch and going through extensive paperwork.

In this comprehensive guide, we guided you about all the steps that you need to go through from account opening to your first deposit.

In case you have any queries regarding the account opening or any other, feel free to drop a comment and our team will guide you further.

Leave a Reply