What are mutual funds in Pakistan and how do they work? Mutual funds have recently gained popularity because of their significant benefits for those interested in investment options.

In this article, we will address all your questions, providing you with a clear understanding of mutual funds, how they operate, and when it is advisable to invest in them.

So, without any delays, let’s jump into it.

What Are Mutual Funds in Pakistan

Let’s first understand what mutual funds are.

A mutual fund, as the name implies, is a collective investment vehicle where individuals contribute their money to a fund. This money is then managed by a professional fund manager, who is an expert in investing.

The fund manager invests the pooled money on behalf of the participants, and any profits generated are distributed back to the investors after deducting the manager’s fees.

Common Types of Mutual Funds in Pakistan

Now that you know what are mutual funds, let’s dive a bit deeper into it.

There are various types of mutual funds in Pakistan based on your goals and risk profile whether you want a stable income every month, are saving for retirement, or just want a new income stream.

The most common ones are:

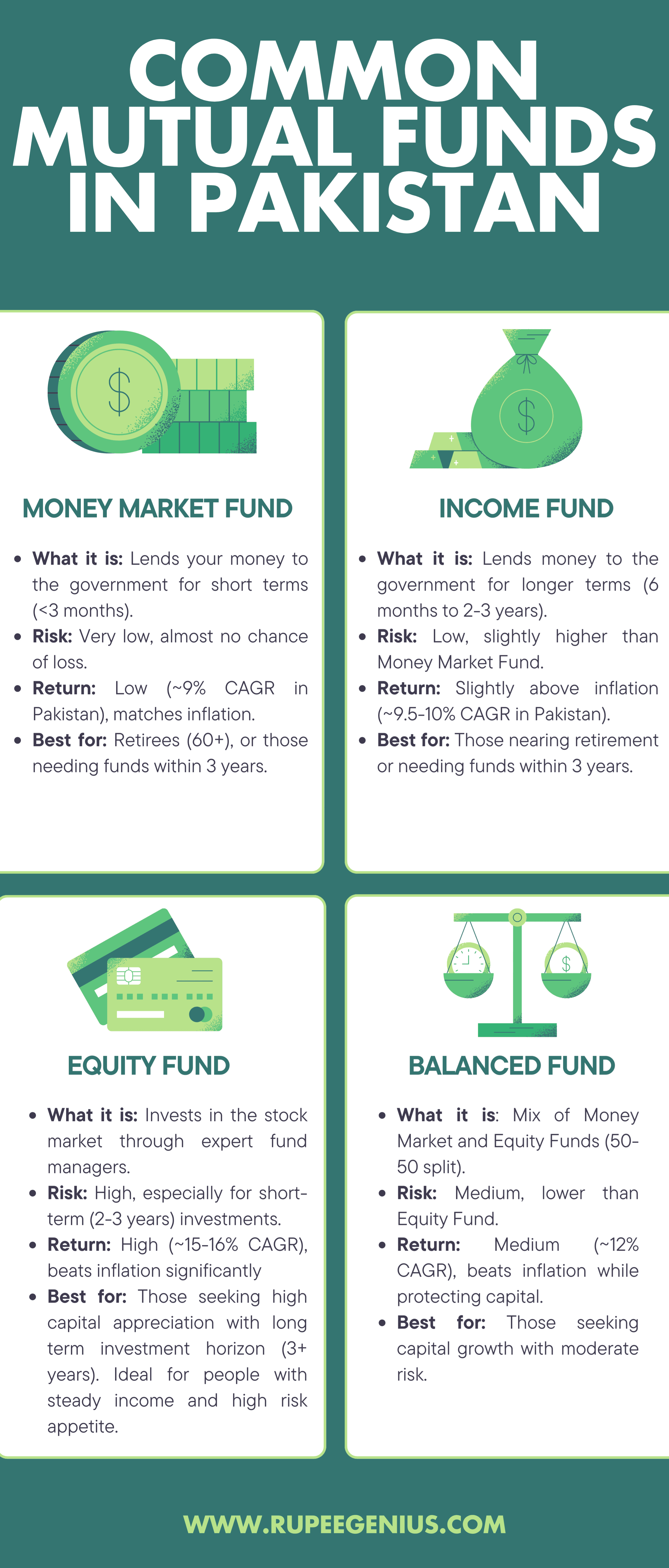

Money Market Fund:

In the money market fund, the fund manager lends your money to the government for a very short duration, less than 3 months for their operational expenses.

Both conventional and Shariah-compliant options are available in this fund.

- Risk: Very low. It’s almost impossible to lose money in this fund

- Return: Very low. Return is also very low in the Money market fund. It usually gives you the return around the value of inflation. The average CAGR of a money market fund in Pakistan is 9%.

- Suitable for: it is suitable for people who can’t sustain any loss to their capital. Like people who are 60+ and have retired or someone who needs the money within the next 3 years.

Income Fund:

In the income fund, the fund manager again lends your money to the government but for longer durations, from 6 months to 2 or even 3 years.

Both, conventional and Shariah-compliant options are available in this fund.

- Return. Low. Return is slightly higher than the money market fund. It will give you a return marginally above the inflation if any. The average CAGR is 9.5-10%.

- Risk: Low. Risk is low but slightly higher than the Money-market fund.

- Suitable for: it is suitable for people who are looking to marginally beat inflation but still keep their capital safe. Like someone who is nearing retirement or someone who needs money within the next 3 years.

Equity Fund:

In an equity fund, your money is invested in the stock market by a team of experts.

Fund managers conduct research to identify the best-performing companies and strategically buy and sell their stocks to maximize profits.

Both conventional and Shariah-compliant options are available within this fund.

- Risk: High. Risk in the stock market is high in the short term i.e. 2 to 3 years. It is only advisable to invest in equity if your investment horizon is more than 3 years because risk reduces over longer period durations.

- Return: High. The high risk comes with high reward and the stock market has been the best-performing asset class in the last 25 years. The average CAGR of the equity fund is 15-16%.

- Suitable for: As the risk is high in the equity fund, it is only suitable for individuals who have a steady income to cover their expenses and have an investment horizon of more than 3 years. Like people in their 20s, 30s, or 40s.

Balanced Fund:

The balanced fund combines the money market fund and equity fund in 50-50 portion due to which the risk is reduced. Both, conventional and Shariah-compliant options are available in this fund.

- Risk: Medium. Risk in the balanced fund is medium.

- Return: Medium. The reward of the balanced fund is also medium. It can beat inflation noticeably while also keeping your principal comparatively protected. The average CAGR of the balanced fund is 12%.

- Suitable for: It is suitable for individuals who want to appreciate their capital while still keeping their capital amount protected.

How To Invest in Mutual Funds

You would have an in-depth understanding of what are mutual funds in Pakistan. If you are looking to get started, then we have created a detailed guide on how to invest in mutual funds in Pakistan.

As a refresher, you need to:

- Create an online account

- Make your first deposit to activate the account

- Now your account is active, you are free to invest in any fund of that asset management company.

The rest of the intricate details are in the guide above. It covers all the aspects from the account creation to your first deposit. Be sure to check it out.

Pros of Mutual Funds

Let’s first talk about the pros of mutual funds:

1. Professional Investment Management

In mutual funds, a team of experts manages all aspects of the investment.

These qualified individuals have years of experience in handling investments and know how to allocate your money effectively to achieve optimal results.

Opting for mutual funds is a smart choice if you lack in-depth knowledge of investments, as attempting to invest on your own could potentially harm your capital.

2. No Effort and Knowledge Needed

The biggest benefit of a mutual fund is that you don’t have to do anything and everything is handled by the fund manager which frees up a lot of your time.

You can just put your money to work and forget about it.

If you are someone who is very busy and can’t spare any time for investments, just keep depositing your money in mutual funds and let the fund manager handle everything for you.

3. Highly Liquid

Another benefit of a mutual fund is that it is highly liquid which means that you can buy and sell your units on any given day.

You don’t have to worry about finding the buyer or seller for your investment, it will be handled by the fund manager.

Otherwise, in direct stocks or ETFs, if you can’t find the seller in the market, you won’t be able to cash your investment. But that’s not the case with the mutual funds.

Cons of Mutual Funds

Now let’s see some disadvantages of mutual funds:

1. Limited Profitability

One of the major drawbacks of a mutual fund is that it has limited profitability. It is impossible to have a multi-bagger return from a mutual fund due to its dynamics.

Peter Lynch argued about these in his book, “One Up on Wall Street”.

- First of all, the mutual fund manager is a person who is at a job and is precisely instructed not to take major risks as it will harm the image of the Asset Management Company, he’s working for in case the investment decision fails. Therefore, the fund manager will only invest in the companies in which other fund managers are investing so he’s not the only one to blame in case the investment goes wrong.

- Secondly, the Asset Management Companies have to compete with the other AMCs to show profitability at the end of each year. Due to this reason, the fund managers prioritize short-term profitability over long-term benefits which result in many missed multi-bagger returns.

2. Fee Structure

As mentioned before, all your profit will not go to you directly but there will be some portion deducted from it as a fee. This fee can range from 1% for money market funds to 5% in the case of equity funds. And for the fun part, even if you don’t get any profit due to the bad economy, you will still need to pay the fee.

And don’t underestimate this small 4% fee because it also compounds over time.

Let’s say that you invest in a mutual fund that gives you a 16% CAGR return and has a 4% expense ratio. It will reduce your profit by 44% over the period of 20 years.

3. No Control Over Investment

One more drawback of mutual funds is that you have no control over your investments. Let’s say you invested in an equity fund; you will have no control over the companies in your portfolio. Your fund manager will be the one to decide what to buy and what to sell.

Conclusion

That concludes our detailed guide about mutual funds in Pakistan.

You would have a good understanding of mutual funds by now. You could also see the different types of mutual funds, their features, and who should invest in them. You could also find the advantages and disadvantages of mutual funds.

We tried to keep the topic simple and crisp. If you have any queries related to the mutual funds, let us know in the comments below and get your doubts cleared away.

Leave a Reply